Table of Content

Use our branch locator to find your nearest consultant. A surplus greater than $50 will be mailed to you in the form of a check if your loan is current in status when the escrow analysis is completed. Delays can occur depending on the way your bank sends your online bill payment to us. Your account number can be found in your Welcome letter and the first page of your monthly mortgage statement.

The cash amount often cannot exceed 80% or 90% of your home equity. If you refinance to a longer loan, you can reduce your monthly payment. The loan will be longer, but your monthly expense will shrink. A mortgage refinance is when a homeowner replaces their existing mortgage with a new one.

How To Deal With Specialized Loan Servicing

However, other loan types may require as little as a 3% down payment. Note that down payments of 20% or less on conventional loans will require private mortgage insurance . Another important factor is your debt-to-income ratio. Your debt-to-income ratio is calculated by taking your monthly liabilities, such as credit card, auto or student loan debts, and dividing them by your gross (pre-tax) monthly income. For example, let’s say your salary is $50,000 a year, which means you make $4,166 a month pre-tax.

Recently acquired by Newrez, Caliber anticipates rebranding, a company official said, though the timing of the changes has not been finalized. Borrowers should always consider the balance between lender fees and mortgage rates. While it’s not always the case, paying upfront fees can lower your mortgage interest rate.

2020 Data |

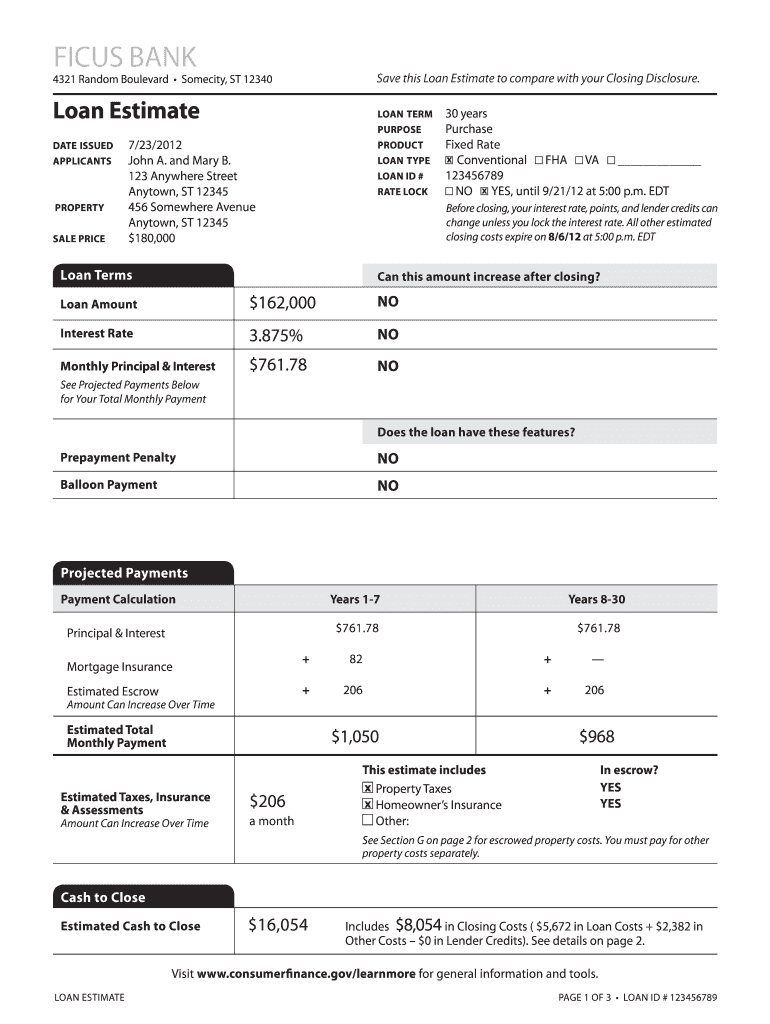

Other industry-standard closing costs such as title, appraisal, and government fees could also apply, but the exact costs vary depending on the specific characteristics of the loan. Loan TypeConventionalHomeOneSMHome Possible®HomeReadyTMFHAOverviewGood if you have a high credit score and steady employment history.Low down payment. By putting more down, your loan will cost less, you’ll be able to get a lower interest rate, and you may not have private mortgage insurance added to your payments.

The app also lets you access your account to upload documents, view the status of your loan application and easily contact your loan officer by phone, email or text message. Caliber Home Loans was among the top 10 highest-volume mortgage lenders in America in 2020, according to the latest available Home Mortgage Disclosure Act data. It offers home loan services through its network of consultants, as well as independent mortgage brokers and loan officers.

Caliber Home Loans At A Glance

VA and USDA loans could require no down payment at all. The minimum credit score Caliber requires varies depending on the type of loan you’re applying for. You might be able to get approved for a VA or FHA loan with a credit score below 620, but conventional loans generally require a 620 or higher. For homeowners with an FHA loan, there’s the FHA Streamline Refinance. The VA Streamline Refinance is also available to VA loan borrowers. Eligibility requirements and closing costs for a mortgage refinance can vary.

Your original loan covered the purchase price of your home. A refinance loan is a new loan that pays off the balance on that original loan. You’ll no longer make payments on the original loan and begin new payments on the smaller refinance loan.

Earn borrowers’ trust by being as knowledgeable about the current market as possible, at all times. First, we're dedicated to putting borrowers on a successful path to homeownership. To achieve that goal, we provide you with tools to make that happen and – build your business.

Loans may close in as little as 10 days for some applicants. Rate quotes are available by filling out an online form or calling. Once you’re a little closer to being ready to apply for financing, getting pre-approved for a mortgage is your next step. You can complete a quick and easy mortgage application online. Then a Loan Consultant will reach out to you to ask you a few questions and verify all your information. You’ll also need to supply necessary documentation to complete the process.

If you’re looking for more than just FHA loans and Fannie and Freddie stuff, they’ve got your covered. In late summer 2017, they announced the funding of their 10,000 VA purchase loan, so it’s clear they’ve got some experience in that department. In terms of government home loans, they’ve got everything. In fact, Caliber even has a special Military and Veteran Lending division solely for VA loans. They also been recognized as a Military Friendly Brand two years in a row .

Your Caliber Loan Consultant can help you discover if and where you qualify. How can you find out if the property you’re looking at is in an area that meets the USDA’s criteria for this loan? Location is key when checking your eligibility for a USDA single family housing guaranteed loan.

Your escrow account is essentially a savings account set up to cover taxes and insurance costs related to the home you’re buying. Your escrow account begins with an upfront balance when you close your loan. Part of your closing will likely be depositing money to cover the first year of taxes as well as the first six month of insurance premiums. Years later, you may have the option to remove your escrow account when your loan balance has dropped to below 80% of the home’s value. Shopping around with multiple lenders can help you find the best terms you can qualify for on a new purchase or refinance. For borrowers on the go, Caliber offers a mobile app for Android and iPhone.

If you have an escrow account, Caliber will pay your property taxes for you with the funds you’ve already deposited in your escrow account. Caliber reviews your account annually to make sure you can cover your property taxes and insurance premiums along with the escrow cushion. This review goes over the deposits and expenses for the previous year and projected activity for next year. Your mortgage loan finances the actual purchase of your home. However, as the homeowner, you must cover other costs in addition to the mortgage itself.

If you have a conventional loan, you may be required to have private mortgage insurance , while FHA loans may require you to pay Mortgage Insurance Premiums . If you’re a first-time homebuyer, closing costs may take you buy surprise. These are additional out-of-pocket expenses that cover of a number of fees involved in the mortgage loan process.

You may also be able to purchase a home with nothing down by using gift funds, and credit scores go as low as 610. As alluded to in their company history, they’re equipped to provide all types of loans backed by Fannie Mae, Freddie Mac, the FHA, and the VA. After that, you can enjoy their comprehensive online and mobile app experience. And best of all, over 75% of Movement’s borrowers see their loans processed and closed within a week. Unfortunately, Better.com doesn’t originate loans in every state, and its palette of government-backed loans is sparse.

No comments:

Post a Comment