Table of Content

A pre-qualification will provide you with an estimate of how much money you’re eligible to borrow for a home and which loan options are best for you. If it’s time for you to look into a home renovation but you don’t have the cash in hand to pay out of pocket, you can use your home itself to make it happen. There are three popular ways to use the equity you’ve built in your home to finance a renovation project. When determining how much you need to borrow for your home renovation, make sure your factor in labor costs, inspection fees, permits, and architectural or engineering services. Have a clear picture of what changes you want to make to your home. Do your research and get a good idea of what it will cost.

They will perform a credit check, and if you’re approved, you’ll receive a pre-approval letter to lend you a specific amount. This step gives you a clearer picture of your budget and the homes you can afford. Mortgage rates are calculated using a combination of economic and geographical variables. Due to the constant fluctuation of the economy, bond rates, and more, mortgage rates are always changing. While you can’t control the conditions that influence mortgage rate calculations, you can control how much you know about your borrowers’ options at any given time.

Caliber Home Loans Mortgage Interest Rate and Cost Review

Ask your Caliber Loan Consultant about special federal programs for home renovations on Title I loans and on energy efficient mortgages. You can also opt for a cash-out refinance loan on your home and use the cash payout to fund your renovation work. Say you’re in the process of buying your dream home, and it’s much more expensive than average.

A year later, they obtained the ability to directly endorse FHA loans and received direct lending authority for VA loans, meaning lending decisions could be made in-house. To get started with Movement, you’ll need to fill out a form and wait for the lender to contact you. Movement Mortgage is a hybrid lender that serves all 50 states via its 650 branch locations and online portal. After you’re preapproved, Caliber uses its state-of-the-art digital underwriting technology to get you through to closing. But if you prefer a personal touch, you can drop in at one of Caliber’s physical branches or call by phone.

Unique Loan Options

Unlike some lenders, Caliber retains the servicing for most of its loans. Once a loan is funded, Caliber will accept the mortgage loan payments and address any questions you may have during the life of your loan. The company also states that in certain cases, it can close loans in as little as 10 business days. Here are a few things to know about this lender if youre interested in their mortgage products. They also have a Premier Access portfolio program that allows loan amounts as high as $3 million with lower credit score requirements down to 650. And the loans may not require private mortgage insurance.

The Fresh Start program also offers low down payment options and low minimum credit scores, along with loan amounts from $100,000 all the way up to $1 million. You can shop a wide range of mortgages, including conventional, government-backed, and low credit score options. They also offer reverse and construction loans plus rate-and-term refinancing.

Regions Served by Caliber Home Loans

Caliber offers eligible borrowers a wide array of loans to choose from, including conventional, government-backed, and specialty mortgages. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty.

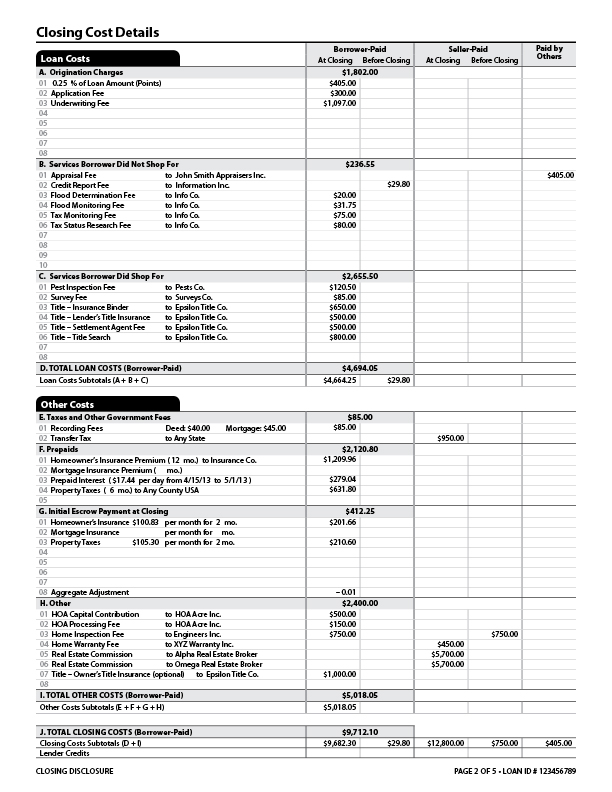

We’ll help you pick the best plan and tell you how much cash you’ll need for closing costs. After creating an account, Caliber gives you the option to apply for a mortgage online. You can upload documents to the web portal and even track your mortgage application via a mobile app. Caliber Home Loans has a broad appeal, with competitive interest rates and a wide range of mortgage loan options for home buyers and refinancers. The 2021 average 30 year fixed rate mortgage across all markets and lenders was 3.15%. Caliber bought out our loan from the original lender we had.

Refinance Your Mortgage

You need to find a loan that allows you to finance it without breaking the bank. A regular loan amount might not be an option because the home value exceeds the normal Fannie Mae and Freddie Mac loan-servicing limits. You may find yourself in this position if you’re buying a luxury home, a home with expensive amenities that drive up the cost, or a home in a pricier neighborhood. This is when you may need to opt for what’s called a jumbo loan.

We may receive compensation from the products and services mentioned in this story, but the opinions are the author's own. We have not included all available products or offers. Learn more about how we make money and our editorial policies. This suite of home financing solutions seems to be even more aggressive, offering home loans with no seasoning requirement after bankruptcy, short sale, deed-in-lieu, or foreclosure. Seem to fall in line with the national average, though its rates are higher than some competitors.

Fees and costs that have incurred during a litigated foreclosure or bankruptcy. FinanceBuzz has partnered with CardRatings for our coverage of credit card products. FinanceBuzz and CardRatings may receive a commission from card issuers.

You can set up free recurring payments online through your preferred bank account. To start the loan process, create an account on the Caliber Home Loans website or the mobile app and answer questions about your finances and the home you want to purchase. Before borrowing, you want to make sure the mortgage company has loan programs that fit your needs and that the company is reputable.

No comments:

Post a Comment